Once again we're at a delicate point on the charts, and after that lovely jump on the ISM data (by the way, it started jumping the gun at least 5 minutes pre-announcement.. hmmm) and then the correction. As pointed out several times by Bala, that climb was weak at best, so it's imperative to keep an eye closely on volume for the rest of the afternoon. If you can't run software like Bala does, you might want to play around with volume by price and get a feel for congestion, etc. that way intra-day. It's the poor man's version, but I never leave home without it.

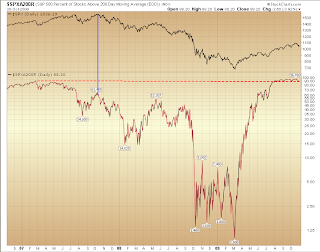

Once again we're at a delicate point on the charts, and after that lovely jump on the ISM data (by the way, it started jumping the gun at least 5 minutes pre-announcement.. hmmm) and then the correction. As pointed out several times by Bala, that climb was weak at best, so it's imperative to keep an eye closely on volume for the rest of the afternoon. If you can't run software like Bala does, you might want to play around with volume by price and get a feel for congestion, etc. that way intra-day. It's the poor man's version, but I never leave home without it. Yet again, IWM and the Qs are lagging and remain the weakest links. I'll post charts or David will later on, as trading is taking up a lot of my attention today, but I did see a chart on SPXA200R earlier on Chartly and recreated it to share with all of you. If this doesn't look like a bubble, I don't know what does at these levels...

Good trading into the afternoon to you all and keep your data coming- we all benefit greatly from it! ~Keirsten

DDT here.

I’ve been quiet today due to multiple reasons, but mainly due to trying to answer one question: “Is this the beginning of one of those trends looking back at 1 year from today we would wish that we’d just positioned our portfolios in the direction of the trend, turned trading stations off and came back in a year….rich and famous….or dumb and broke…never know until it is over.

Anyhow – here is a chart of /NQ, it does show significant change of personality, it is not just lagging stronger indexes, but it goes from one death red downside sequence straight to another – now in the 3rd one from the top.