At this point on the tape, and as Osi mentioned earlier.... might as well buy a lottery ticket and tack it to the wall as to guess what's next this week on the tape. But that's okay, we're patient, and when volume does return in the new year we should be very well practiced on our various methods of T/A and be ready for just about anything. But for now, we're still on gap up/sideways/slightly down/possible 3:30 ramp job/Groundhog Day until further notice. The McClellan Oscillator is looking a little bit interesting tonight, but other than that I really can’t dig up any mind blowing clues on the charts. If you can, please do share. The reason I mentioned GS a few times today though was because I do think it bears watching for the next few sessions, and undoubtedly, it was showing strength today. On the other hand, it has been showing weakness since October and the general market hasn’t skipped a beat, so perhaps it’s not the weathervane it has been in the past? Before I share Zig's T theory charts, I also wanted to let you know there is another Corey Rosenbloom webinar next week for those who are interested. Best of trading to you hardcore crazies who have made it this far in these holiday weeks- it's almost over. ;-) Have a very, very Happy New Year celebration! As Squiddy mentioned earlier, it’s a blue moon tomorrow night, and also partial lunar eclipse for you moon cycle watchers. One last thing: we have a zillion methods applied to our trading techniques, and I know DDT would be the first to say we’re all open to everything under the sun and then some if it makes us a profit. Like many of you, I’m a complete newbie to DeMark, but trust me…. it won’t stop me from making a fool of myself or asking a million questions along the path to enlightenment. I hope the rest of you will join in with me by making fools of yourselves too so we can learn this crazy stuff? Good, I knew I could count on you. DDT and I will be checking in here and there in the interim during the holiday weekend, and fortunately our group here can keep the ball rolling in the meanwhile. See you all on the other side! 2010 is going to be a great year for TTWrs! And with that, let’s start off the new year with a lesson from Zig Zag for all of you fans out there…..

At this point on the tape, and as Osi mentioned earlier.... might as well buy a lottery ticket and tack it to the wall as to guess what's next this week on the tape. But that's okay, we're patient, and when volume does return in the new year we should be very well practiced on our various methods of T/A and be ready for just about anything. But for now, we're still on gap up/sideways/slightly down/possible 3:30 ramp job/Groundhog Day until further notice. The McClellan Oscillator is looking a little bit interesting tonight, but other than that I really can’t dig up any mind blowing clues on the charts. If you can, please do share. The reason I mentioned GS a few times today though was because I do think it bears watching for the next few sessions, and undoubtedly, it was showing strength today. On the other hand, it has been showing weakness since October and the general market hasn’t skipped a beat, so perhaps it’s not the weathervane it has been in the past? Before I share Zig's T theory charts, I also wanted to let you know there is another Corey Rosenbloom webinar next week for those who are interested. Best of trading to you hardcore crazies who have made it this far in these holiday weeks- it's almost over. ;-) Have a very, very Happy New Year celebration! As Squiddy mentioned earlier, it’s a blue moon tomorrow night, and also partial lunar eclipse for you moon cycle watchers. One last thing: we have a zillion methods applied to our trading techniques, and I know DDT would be the first to say we’re all open to everything under the sun and then some if it makes us a profit. Like many of you, I’m a complete newbie to DeMark, but trust me…. it won’t stop me from making a fool of myself or asking a million questions along the path to enlightenment. I hope the rest of you will join in with me by making fools of yourselves too so we can learn this crazy stuff? Good, I knew I could count on you. DDT and I will be checking in here and there in the interim during the holiday weekend, and fortunately our group here can keep the ball rolling in the meanwhile. See you all on the other side! 2010 is going to be a great year for TTWrs! And with that, let’s start off the new year with a lesson from Zig Zag for all of you fans out there…..

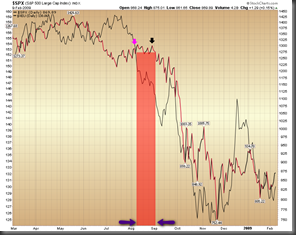

Goodbye 2009! Don’t let the door slam on you….