If you hold a cat by the tail you learn things you cannot learn any other way. - Mark Twain.

If you hold a cat by the tail you learn things you cannot learn any other way. - Mark Twain.

It looks like Gold is that cat right now for some of the gold bugs who were buying like maniacs near the recent top. The healthy pullback that was anticipated is now here, so for those of us shorting or wanting to get long, keep a close eye on your levels of support because this cat is moving fast. I haven't personally test driven the volatility index on gold for trading purposes, but some of you might be interested in doing so on your own, and I'll probably play around with it too as volatility climbs. If so, you can access the GVZ chart here, and hopefully it will be of good use to you. I personally don’t think we’ve heard the last about gold, and will be stalking it carefully.

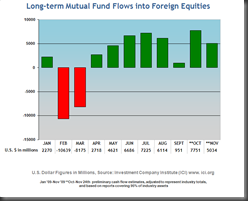

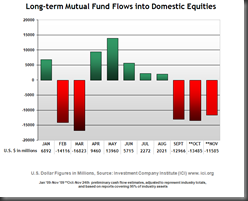

Meanwhile, our next challenge is obviously to watch the potential crumbling of the dollar/equities correlation and find the best ways to trade it. As DDT mentioned in the Sunday post, don't get too excited yet that a stronger dollar is going to tank the tape because just the opposite could very well happen. Why do I say that? Two reasons: it's the trade that would fool the most, and secondly I present below the latest graphs from ICI data and this week I've included the money flow into foreign equities since January. You'll see that money has continually flowed into foreign funds, even when U.S. equities have seen the swamp draining slowly, but surely. So.. let's just say for kicks and giggles something like another Dubai happens, maybe two Dubais even. There is a good chance what we could see is money running to the U.S. two-ply $ for safety, as well into what might be suddenly considered a safer risk trade on U.S. stocks. At that point, domestic stocks become attractive, commodities could start moving lower, emerging market shorts might be our play... and the onus is on us to game that shift and trade accordingly, much like we shorted the living daylights out of the RUT. Time will tell, we'll just have to keep our fingers on the pulse, and they never make this easy, but I thought I’d toss that idea out there to keep it in mind. The dollar has a lot of work to do before we get too comfy with anything ahead.

Economic news is on the light side this week, but there are a few items tomorrow. ICSC-Goldman Store Sales at 7:45, Redbook at 8:55, and the 3 Yr Note Auction at 1:00 PM. Good trading to you all!

|

Also worth keeping an eye on right here are the refiners. Note the crack spread and keep an eye on that for a potential long trade. Thanks to Zig for the chart on TSO.

|  |