I wanted the cashmere sweater and all I got was this lousy fruitcake? Well, that's how the dollar/equities story seems to be playing out currently in the minds of a lot of traders who were counting on a rising dollar/falling equities scenario.

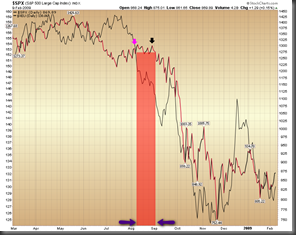

I wanted the cashmere sweater and all I got was this lousy fruitcake? Well, that's how the dollar/equities story seems to be playing out currently in the minds of a lot of traders who were counting on a rising dollar/falling equities scenario.One of the most discussed issues in the blogosphere I've seen in the past several days is the lack of "correlation" concerning the recent correction with the Euro/USD or /DX alone and the lack of correction in the U.S. Markets. Several times in past months we've seen historical charts that do, in fact, show the dollar can and has traveled up and down with equities through the years, so we have that to remember. But something I saw on one of the EW blogs last night, charted by one of the posters. was also interesting RE: the Euro Index v. the SPX, so I drew up some charts for a visual look at what took place in late '08 when the Euro Index corrected down. It all looks so very similar insofar as the index moving sideways, etc. prior to playing catch up with the declining XEU. Will this happen again? It's like I always say... how should I know, and it remains a "maybe." We are under completely different circumstances at this point, but it's something we can consider, we just can't trade from it. I've also included a look at the gold index and how it also topped before the SPX. Truth be told, we have no idea about these things, we can only try to game it day by day until a true trend reveals itself.

The economic calendar tomorrow includes: Before the bell- MBA Purchase Apps, Personal Income/Outlays. Consumer Sentiment at 9:55, followed by New Home Sales at 10:00. Petroleum Status Report will follow at 10:30 AM. In other words, green shoots and Skittle shooting unicorns.

|  |

Since no one seemed to like Mariah’s Go-Go boots yesterday,