... and you just know they had to put up that sign due to multiple attempts to feed the crocs!

... and you just know they had to put up that sign due to multiple attempts to feed the crocs!

“Intuition is a combination of historical (empirical) data, deep and heightened observation, and an ability to cut through the thickness of surface reality. Intuition is like a slow motion machine that captures data instantaneously and hits you like a ton of bricks." - Arbella Arthur.

I had an epiphany today, after I took a few dozen bricks hit in the head. In a message to my trading Svengali, I realized I have waited nine long, teeth gnashing months to short this tape. Now all of a sudden I think it's time to get cute and buy the dips? A little late to that party, no? My point is to share what I'm trying to retrain my trading brain to do, right here, right now, and make it public in case anyone else is dealing with this too. Yes, there will be bounces, but the nature of this tape, the nature of the way they're delivering earnings (and most often now selling them off,) and other financial news has taken on a new bent. When Steve Lies-man is negative on his hero Benny, it's time to turn off the TV and trade the charts. They're telling us something already, in fact, they're yelling at us! Even on a retrace we could be looking at the bear patterns of the decade going on. The tape will let us know. Okay, so that's my little rant for the day and I'm ranting at myself, you're having to listen, sorry about that, but this is my trading family and we share and bare it all around here. :-) We'll continue to swing trade intra-day of course, it's what we do, but earth to TTWrs, watch your back and watch your money, this is a slippery slope, where patience reigns supreme, and a little touch of intuition never hurt anybody. Much the way they ran this tape up, they'll do the same thing on the way down. The floor arrives when THEY decide it arrives, and it will go much further than we think sanity might allow. (just like the bear rally – will we ever forget?)

Tomorrow's economic news includes: GDP at 8:30 AM, Chicago PMI at 9:45 and Consumer Sentiment at 9:55.

Earnings include: ACI, CVX, FO and HON. Looking ahead to Monday will be: XOM, HUM and SOHU. For a full list click here.

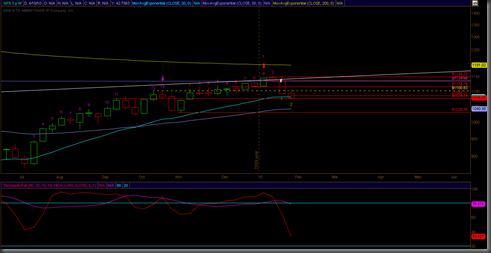

For you Zig Zag addicts- here’s the most recent look at what he’s watching for the days ahead on the T chart. Note, this does not include today’s price action,

but the time factor is still in play.

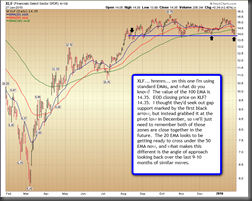

For EWrs, stop by Alpha’s blog for some great charts tonight, (but make sure you come back or I’ll send a posse out to find you.) Thanks for sharing, A! Below is another chart he generously shares with us here on TTW.

FX traders: I was thinking last night that a good way to kick off learning about FX might be to do some Q/A we can publish here on TTW? If you’d be willing to pitch in on that effort, let me know and we’ll do it via e-mail.

Make sure to get some rest tonight, fellow traders, and we’ll see you all later! FX Crazies - your mission is at hand! G/L tonight and don’t get too crazy! (like me)

One of Warren Buffet jokes.

One of Warren Buffet jokes.