It appears that some of the news flow is starting to make things interesting, and as I posted on the last thread, pay attention to the filter on the lens, not the lens itself. If the charts are setting up, the news will follow. I think I mentioned early on last week about Bernanke's lack of confirmation and we watched that play out beautifully all week long before it was on anyone's radar. As Inna said, keep your ears to the ground and let's keep a good listen for things that might help us trade this coming week, and more importantly, think outside the box a little. This Bloomberg mention of the uptick rule back on the radar is a good example. This was a huge issue back in February '08 as you'll all recall, and they had special hearings right through July with no decision coming out of the SEC. So why now? I suppose at quick glance we could glean they're worried about a crash and want to protect the tape. But thinking outside the box leads me to believe bringing back the uptick rule will not soften the blow, but in fact could make things even worse. My cynical little brain then wonders: who's short already and is ready for a deeper correction/trend change and doesn't want a lot of company when it happens? I was actually going to bring up the topic of how to filter for good possible short candidates here on TTW, and one of the ideas is to filter for low short interest. A good example of what can happen to stocks with very low short interest is here in this Finviz scan I did over the weekend. The filter was set to < 5%, and note the low short interest on the top four percentage losers on Friday when you have a minute.

It appears that some of the news flow is starting to make things interesting, and as I posted on the last thread, pay attention to the filter on the lens, not the lens itself. If the charts are setting up, the news will follow. I think I mentioned early on last week about Bernanke's lack of confirmation and we watched that play out beautifully all week long before it was on anyone's radar. As Inna said, keep your ears to the ground and let's keep a good listen for things that might help us trade this coming week, and more importantly, think outside the box a little. This Bloomberg mention of the uptick rule back on the radar is a good example. This was a huge issue back in February '08 as you'll all recall, and they had special hearings right through July with no decision coming out of the SEC. So why now? I suppose at quick glance we could glean they're worried about a crash and want to protect the tape. But thinking outside the box leads me to believe bringing back the uptick rule will not soften the blow, but in fact could make things even worse. My cynical little brain then wonders: who's short already and is ready for a deeper correction/trend change and doesn't want a lot of company when it happens? I was actually going to bring up the topic of how to filter for good possible short candidates here on TTW, and one of the ideas is to filter for low short interest. A good example of what can happen to stocks with very low short interest is here in this Finviz scan I did over the weekend. The filter was set to < 5%, and note the low short interest on the top four percentage losers on Friday when you have a minute.

Most of all fellow traders, good luck to us all this week, it could be crazy and we need to stay focused, disciplined and helpful to each other. I know my own trading has improved beyond belief because of the help I get on this blog while we’re trading live every day. I think we’re all aware that AAPL reports after the bell tomorrow, and I’ll leave it up to you to study the rest of the week’s earnings ahead tonight. We also have FOMC meeting Tues/Wed and GDP coming out on Friday. To top that off, the new Senator from Mass. will be sworn in on Thursday, and of course Ben’s neck is still on the line until and unless they confirm him before next Sunday, Jan. 31st. Let’s also be aware this is end of the month, so the window dressing notion is still in play as well.

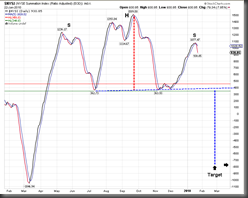

On to some charts. Interestingly enough, leading indicators, BDI and Copper, both finished Friday positive, so let’s keep an eye on both of those too going forward. Zig Zag has done a beautiful fractal to include a potential T-theory turn time chart to share as well as his T-theory chart on AAPL, and I’m sharing some other charts of interest, including my fantasy chart on NYSI, and preachy little chart on TRAN and trend lines. See you all in the morning, bright and early! :-)

|  |

|  |

|  |

|  |

|  |

And finally Zig Zag’s T-theory Fractal Chart

EDIT to ADD: A shameless plug for our friend and fellow trader, Steveo. Steve works endlessly on some of the best charts in the blog-o-sphere and is beyond generous with his ideas, so make sure to check out his work at Hawaii Trading. We are so fortunate to have not only Steve, but AG, Alpha and Bala as well, who run their own blogs, but still take precious time to pop in TTW during trading hours and give us alerts when they see something important. Thanks guys!