"Chance favors only the prepared mind." -Louis Pasteur

"Chance favors only the prepared mind." -Louis Pasteur

We've had an interesting week so far, TTWrs, and no doubt with more big earnings announcements ahead, we could see a lot more volatility in the coming days ahead. Let’s embrace the chance to swing the trades intra-day, and not worry about the top/bottom or in between. I'm going to share a hodge podge of charts tonight, along with Zig Zag's latest T-theory chart. Osi's sheeple once again bought the dip and/or the bears are just so rattled from almost a year of being burned they cover for fear of overnight antics. Many of us are a perfect example today- we'd love another down day tomorrow, but as Osi also says, it seems to have become illegal, so we're taking profits and running with the money when/if we can. In any event, let's just stay prepared for both directions and take it all in stride. It's almost like trader's post traumatic stress syndrome, but find your zone and trade right in it.

One of my hypothesis about the dollar moving higher was that the correlation between the S&P might not happen. Some of you might remember my pondering that idea way back in December. I'm still of the belief that we could very well continue to see money not only roll into the dollar, but also certain sectors of U.S. equities as a flight to safety. When/if this changes, we'll be the first to know. But it still remains a distinct possibility in the months ahead to be aware of. Meanwhile there are some good opportunities to trade the foreign markets this way via the ETFs, so I've included FXI again, as well as EWW for your viewing pleasure. ;-) Let's keep our eyes open for this type of trade, and please share if you have more ideas on how to play that theme.

Tomorrow's earnings highlight includes: before the bell- GS, FCX, ESI, LUV, PCP, UNP, UNH. Post session includes: BNI, COF, GOOG, ISRG and WDC. For a quick Friday preview on earnings: BBT, GE, JCI, MCD and SLB.

On the economic calendar before the bell: Jobless Claims, Leading Indicators and the Philly Fed Survey. For you oil and gas traders: Nat Gas report at 10:30, followed by Oil Inventory numbers at 11:00.

There are also several important events coming up next week to be aware of as traders, including the first State of the Union to be delivered by dear leader on the evening of the 27th. This is also the same day AAPL will unveil the i-Tablet. Some may not be aware that Benny has still not been confirmed either, and the deadline is January 31st. If I had to guess, I'd say next week could be very interesting in many ways.

Have I put you to sleep yet? I'll see you all later on, and thanks for this fantastic group of traders. To all of you who are new posters, we welcome you and very, very much and appreciate your participation with us day in and out, please stop by often!

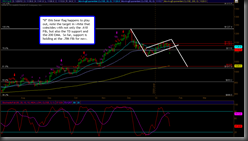

My additonal note on Zig's gorgeous chart: note the "M" pattern?

For our TTW FX night crew! Get ‘em tonight, guys!