While looking over a multitude of charts just now, I come away with one thought in mind- it's about as clear as mud. Unlike my view and conviction back near the top in April, when we had more than enough clues a near-term top was approaching via international charts, indicator charts, LIBOR and the like, but the current view is mixed technically from what I can see.

While looking over a multitude of charts just now, I come away with one thought in mind- it's about as clear as mud. Unlike my view and conviction back near the top in April, when we had more than enough clues a near-term top was approaching via international charts, indicator charts, LIBOR and the like, but the current view is mixed technically from what I can see.

As you all know, I am constantly watching breadth during the intra-day action, and the noticeable and constant rise of new highs v. new lows on the NYSE has been giving me a glaring bullish stare, but much like I noticed back in April, the NDX is balanced at best right now, but I see no clear advantage as a clue via NDX NH/NLs just yet either. The bears have been chatting about various cycle markers for the past two weeks, but all we've seen so far are interim dumps and pumps over and over again. Will these cycle markers hit or is this just another Don Quixote moment in the trading cycle? I have no answer for that.

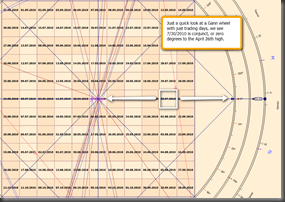

What I do see is mixed evidence in favor on the side of the bulls VST right now, and in light of the July bounce, but I keep it in the back of my mind that complacency on their part could also be their undoing, and could come swiftly when least expected. That's not a way to trade though, and if the only thing you do is wait to short, you could be waiting a long time while money is being made and the tape creeps higher. Basically, there is no clear-cut path here other than very short-term ups and downs if you can scalp and stay as safe as possible. Are you afraid you'll miss the trade of the century/Black Swan/moment-in-history? That's the wrong tree to bark up as a trader, and will leave you frustrated and angry, rather than productive in your trading. How do I know this? Because I battle at the skirmish line of bias on a daily basis personally, and have to constantly work on bringing myself back to center. My own best trades last week were based on what I saw unfolding on the charts, not what I wanted to happen, or worse... expected to happen based on my bias. I've observed EW, DM, Gann, pattern trades and then some- all scrambling to re-adjust their counts and projections for the past month because that's exactly all this is- projections and guesses, and often without a good look at anything but a single chart in front of them. Fifteen minutes turns into 3 days, an ABC turns into an extension or a truncation, 180 degrees turns into 250 degrees, three white soldiers turns into a hanging man doji... and the beat goes on. By the way, this includes me- I am guilty as charged. But, bottom line, these are the only tools we have and we're not much of a match against liquidity pumping, surprise rug pulling and other various hat tricks. Some would say this is the sign of a near-term top. I say bunk- we are specks in a big sea of crooks. I trade for the cold, hard cash not brownie points for getting lucky with a technical projection days in advance. When the ducks all line up neatly, this job is a little easier, but we don't have those circumstances currently and it's a tough tape to trade for both sides.

So where are we? We still have no higher low/higher high in place on any of the indices medium term, so an early victory dance from the bulls is premature. They hit July with positive divergence, but eventually the music stops and negative divergence can come like crack addict in an unlocked Best Buy. We have a ST higher low, but multiple lower lows/lower highs are still intact. Unless and until that's negated, the MT trend remains down, with expectations of head-fakes until this trend is negated on multiple time frames. TRAN is the only signal I see with a perfect double top, if that's a double top that will hold. See how clear this really is? About as clear as mud. The absolute key will be to stay bias neutral and objective with the charts in front of us, and jump on opportunities as they present.

Sorry for the long-winded text, but there's so little time during the trading week and I wanted to share my thoughts, and stay a little more quiet during the weekdays to focus on my own trading book, as I’m juggling more positions than I normally do.

Enjoy the charts from Wallfly and Osi if you missed them on the previous post. Thanks to both of them for their hard work. Best to you all as the trading week begins on Sunday night. :-)

|  |  |

|  |  |

|  |  |

|  |  |

|  |

|  |

Yeah, that’s right, I used pink on the video surround, so sue me.