By the way TTWrs: I think we might have missed wishing DDT a Happy Birthday, but better late than never. He's a Taurus- isn't that ironic? HA!

By the way TTWrs: I think we might have missed wishing DDT a Happy Birthday, but better late than never. He's a Taurus- isn't that ironic? HA! He has his hands full, and so do I, so I know he appreciates you regulars who keep the ball rolling over here during the day. Hat's off to you all for that!

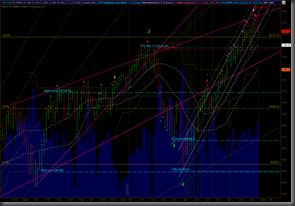

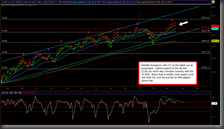

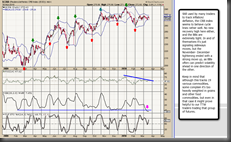

I'm tossing up a few basic charts to look at. Nothing fancy, just the simplest of things to pay attention to. I'm monitoring the NYMO intra-day and it went up to -11 today before it pulled back, so no touch of the zero line, but that might be good enough for a short-term pullback. The IHS I shared on the dollar seems to have worked out well so far too, but it’s getting frothy up here, and the EUR, although hitting new lows today is facing support from below at the ‘08 low.

We all know the games that are played during OPEX though, so be on your toes in both directions. That's my best advice. I'm still watching/waiting for next Thursday as it has a lot of what Joe8888 calls vibrational "stuff" surrounding it. Laundry followers are keeping a keen eye on that day, too. For you loonies, we're in the New Moon phase now.. will that work? I don't know, I continue to err on the side of caution either way, and keep the tin foil adjusted. No wave counts, nothing fancy, just trade the tape they give us and expect to have them not make it easy.

The VIX is of special interest here for certain, and the knuckle draggers are once again warning the peasants to buy put protection after last Thursday's tank-a-puhloozah, so volatility could be getting itself very cozy at elevated positions.

Good trading to you all, and have a good Friday!

|  |

|  |

DDT.. no kvetching about your birthday either.. just give this a good listen when you get back to the blog. ;-)