"I foresee that man will resign himself each day to new abominations, and soon that only bandits and soldiers will be left". - Jorge Luis Borges, Argentine writer/philosopher

"I foresee that man will resign himself each day to new abominations, and soon that only bandits and soldiers will be left". - Jorge Luis Borges, Argentine writer/philosopher So why the Garden of Forking Paths? Borges conceived of "a labyrinth that folds back upon itself in infinite regression," asking the reader to "become aware of all the possible choices we might make." Sounds a lot like trading this tape successfully to me- must remain aware of all the possibilities and don't get hung up on any one thing, or hunt for things on charts that justify your bias. (me included) Within the theme of "folding back on itself," take a minute to look at the potential mirror image chart of SPY done by Corey Rosenbloom. (wish I'd seen this first)

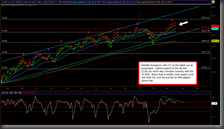

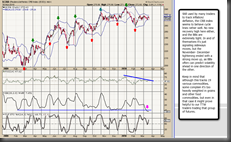

After an interesting week of stretching the tape even further up, we witnessed all of the major indices printing new recovery highs from a relentless push since the February lows. However, the close on Friday takes us back to the labyrinth again on the charts. Although the Dow caught up and once again printed a new recovery high on Friday, all three major indices closed below their previous closing highs, EOD. While "overbought" can remain in that state for a very long time, (as we've witnessed since March '09) the healthiest thing for the bulls right now would be a constructive pullback. We've seen little, if any, backing and filling normally present in a healthy market. But this is a zombie -never doubt how long a zombie will wander. If Friday was the beginning of "the" pullback, we'll have to watch carefully at each fork in the path for more clues to plan our trades. In other words, all hands on deck TTWrs- let’s nail this one down together. Also pay heed to the speed/depth of any pullback- IMO, a deep spike down does not necessarily favor the bears, as was the case on the bounce off of the 200 MAs in February. A slow drip might be more preferable on the short side.

Osso's Thursday/ with a Friday lower low signal is in play this week. Additionally the 21st-22nd are important Gann dates, and March 30th is a full moon. (I know how this drives DDT looney.. errr, crazy, but somebody has to tease him once in awhile.)

I'm including a chart of the steel sector ETF in the chart zone that might provide a good springboard for hunting down some individual trades for this coming week. I'm also including a chart on $CRB which is showing something of interest in the way of the Bollinger Bands. Earnings of interest this week include both BBY and ORCL on Thursday, and of course we’re sitting here waiting for the health care vote.

We welcome Alpha home from his journey, and wish safe and happy travel to our good friend and trader JoeyNickels today, as he travels to Buenos Aires - and will even meet our favorite South American trader, Osso! Joey, you will be missed very much. Buen viaje!

|  |

|  |

|  |

|  |

|  |

Okey Doke… as Joey leaves for Argentina it’s time to Tango (electronica) with the Tape. Good trading and best of luck to us all this week. We have a TTW birthday tomorrow, and this has, in the past, brought good things to us. I will reveal the birthday trader tomorrow. jej jej jej

DDT here

"Proudly" announcing availability of Trading to Win on Amazon KINDLE (this is your chance to support TTW that you all SAY you LOVE for only $1.99 per month...well - I say a lot of things too...)