As we bid our friend and fellow trader, Alpha safe travel on his European adventure today, let's take a new look at the charts and where we stand currently. Bulls are fully convinced we'll keep floating on this helium filled balloon, while bears continue to grumble at the lack of volume, logic, fundamentals and a list a mile long why none of this makes any sense. Harry Reid took the cake today to be certain, but I’ve been saying it all along- for those who continue to chant that unemployment numbers are a lagging indicator, please go preach it at your local unemployment office to the line of people standing around. One hour per week now qualifies you amongst the gainfully employed. Beyond that though, please consider that in the coming months of these UE reports, the census workers are going to boost the numbers like a bat out of Hades, so keep that under consideration going forward, and how it might affect the tape. The upside for bears in all of this? Those same census workers will leave the payroll numbers en masse later this year and that could leave quite a gap. I’m sure the powers that be are hoping against hope that by then the private sector will be in repair and ward off any big dips in those numbers. We’ll see. Meanwhile, If you didn’t believe this tape is bullish before this week, Friday’s action should have convinced you to be cautious shorting it at this point. ( I know, I know… thank you Captain Obvious.) We don’t have to like it, we just have to trade it. It’s kind of like lima beans.

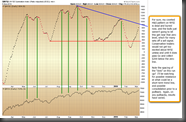

Chart time - This is a random collection of things I wanted to share over the weekend, both bullish and bearish. Zig Zag is also sharing a fractal chart he’s been tracking of the 1987 “era,” that you’ll see below, and there has been a lot of discussion on this comparison in the blog-o-sphere lately, so I thought you’ might enjoy his work. I am not posting the chart on gold today, but be aware it did close red today, along with the dollar. There was also an interesting article in WSJ this week about BDI that’s worth a read- you decide. Scrill… if you have a minute, I noticed we have a Slosh on 3/11, but this is your area of expertise, so guidance would be great as to what you see going on there. One last thing- the Ticker Sense Sentiment poll numbers are looking rather interesting here too, so take a sec to look.

Before I forget- to all of you who took the time to share charts, links, random thoughts and your good humor this week, many thanks as always. Everyone seems to have a job in here- from Mau and the morning Laundry “list,” to Douala and Pricey for their timely postings of McH, to DDTs buddy, Brandt, who has been sharing with us more often.. thank you all so very much. Rest up these next few days, be ready to roll on Monday with a fresh outlook, and let’s attack this tape with positive energy next week. Read DDTs quote at the top of the blog, and try to apply that while you trade.

|  |  |

|  |  |

|  |  |

|  |  |

Zig Zag’s 1987 Fractal comparison

Hanno un fine settimana rilassante … Salute! ;-)