As quite of a few TTWrs mentioned today, the bear was feeling a little bit green around the gills, and not in the way of making cash today, either. I haven't even read any of the usual suspects in Financial news today so I have no idea how this rally is being portrayed, and quite honestly I'm going to continue to do more of the same throughout this year. Am I tempted to read KD and ZH? Of course I am, but it did nothing for my profit line last year whatsoever to lament what "should be," versus "what is," so who needs it? If some earth shattering bit of information comes across the wires, we'll either share it right here between us or we can bet we'll see it show up on the tape.

As quite of a few TTWrs mentioned today, the bear was feeling a little bit green around the gills, and not in the way of making cash today, either. I haven't even read any of the usual suspects in Financial news today so I have no idea how this rally is being portrayed, and quite honestly I'm going to continue to do more of the same throughout this year. Am I tempted to read KD and ZH? Of course I am, but it did nothing for my profit line last year whatsoever to lament what "should be," versus "what is," so who needs it? If some earth shattering bit of information comes across the wires, we'll either share it right here between us or we can bet we'll see it show up on the tape.

Moving along.... talk of fractals and more are back en vogue a bit, so I thought I'd also share the link to dshort site again for several views of former big, bad bear market recoveries and subsequent moves back down again into the depths of Hades. This link takes you to just one view and from here you can access the whole kit 'n kaboodle of comparison charts for kicks on the left navigation bar.

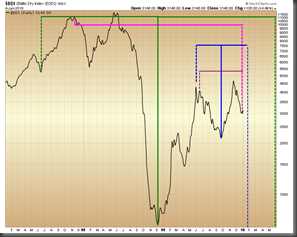

As I was poking around for breakout candidates and potential momentum trades for tomorrow the two specifics that jumped out most of all were a group of financials as well as both the Chinese auto sector and Chinese ag stocks. Top that off with a group of cloud computing/data storage stocks and it's a treasure trove of good possibles going into tomorrow. Rather than post them all here, I'll share links to the charts as groups via Finviz, as the list(s) are lengthy. We also saw a nice breakout on the refiners today, so a pat on the back all around for watching that sector ahead of the pack. Additionally, the dry bulk shippers had a nice day and I'm sharing my version of the T chart on BDI sans the stochastics, but if you slap it on your own chart it appears to be turning up nicely here. This is a longer time frame only though, so as always, use caution and this chart is purely experimental, not gospel predictive.

Potential momentum trades with a caveat: watch the volume on everything, and some are obviously better potentials than others in these groups.

Finnies Charts

Dry Bulk Shippers

Computing

Chinese Ag and Auto Stocks

Misc.

Finally, and with much thanks to TransworldDepravity (love that handle btw) are two charts of interest.

According to TWD: "I have been tracking a potential game changing little correlation over the past week using VIX, UUP, and SPX. Some of you may have already seen this last week. The basic premise to the two year chart is this. (1) VIX is in the 20-25 region (2) UUP crosses over VIX (3) SPX is positively correlated to UUP. Now, whenever this correlation comes into focus, the dollar cross makes a large initial rise, followed by a small correction, before rocketing higher. It is after this second rise that the SPX falls. Now it appears that a small correction has just occurred again after an initial rise in the dollar. Do we get follow through again?" We're game to watch along with you TWD!

Tomorrow's economic bloviating includes: Motor Vehicle Sales, ICSC-Goldman Store Sales and the Redbook. Factory orders and Pending Home Sales at 10 AM EST. Good luck and good trading tomorrow... let's get 'em again!

Edit to add ZZ’s T Chart for you T fans ;-)