... you thought I was going to say destruction, right? :-) Tricked you. We are a fair and balanced trading site and prefer to make money in both directions. That's why I'm going to share some bearish looking charts tonight. :-) I kid, I kid!

... you thought I was going to say destruction, right? :-) Tricked you. We are a fair and balanced trading site and prefer to make money in both directions. That's why I'm going to share some bearish looking charts tonight. :-) I kid, I kid! This was a week for a bouncing feline for sure, but the bounce might be running out of steam as there are certainly some charts that aren't playing along right now. Still... there are plenty of arguments for the short term bull, but I'm having a difficult time looking at various charts with decidedly bearish configuration to the moving averages, and then some. But let's be patient, the tape we want will come to us either way, it always does. It's just some of us are more anxious to get the show on the road than others. Whether or not they gap it up tomorrow or not really doesn’t matter in the big scheme of thing, but lately they’ve been setting the table with a nice meal only to yank the table cloth before obvious targets are hit- and I mean in both directions, so if you’re long or short, keep that in mind. They are the House, we are the players.

On the economic calendar tomorrow we have: Retail Sales at 8:30, Consumer Sentiment at 9:55, Business Inventories at 10:00, Nat Gas Report at 10:30 (Go Mau and Big!) Petroleum Status Report at 11:00, and finally the Treasury Budget at 2:00 PM.

Let's move on to some charts, and this is a real hodge podge tonight, but it's time to look some things over we haven't seen in awhile.

|  |

|  |

|  |

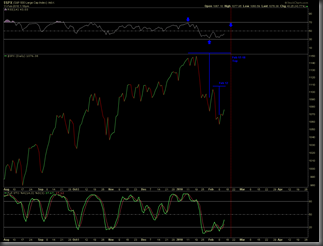

Zig Zag’s latest chart, and he *estimates* a possible turn time at 11:00 EST