Sorry folks - have not even had a chance to touch my laptop until now (not even speaking of looking at the charts), just posting this as (hopefully) solution to "prior thread mysteriously closing by itself" (Later on this might be updated)

|  |  |

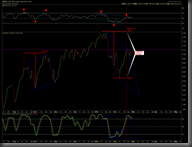

Yesterday's action was… wonderful for those who were positioned short going into the market open …and who were smart enough to take profits.

I am dumb and I did not take over 20% profit on my options account (I have different account for everything – I just don't remember where they are)

Profits I did take saved my sanity when, after I got home after lunch, I saw now only retracement to reasonable levels, but briefly some shades of green on ($SPX)

As much as I wanted to say that the game is rigged, that all crooks deserve to go to jail, that GuberMint which is supported by only 20% of population they govern should get the hell out of the way, peacefully pretty please..no? Don't want to stop looting? Not until Stopped? OK… duly noted… So, as much as I wanted to do something which would be conveniently rationalized by human emotions – I did squawk, nada, zilch… I just sat there for a long time and tried to understand – what part of my brains temporary stopped functioning yesterday? Normally when I have HUGE on the spot profits – I take it and run (I played Blackjack in the past life and some casinos were not very happy to see me). Not yesterday….

AnyHOO – I did get back AT the market utilizing The Only Way I can afford to do that – picture is right above – you get the picture. (I kind of have small stinky bathroom – could not take that picture straight…or may be…just wanted to get out!)

P.S. This video is still being processed. Video quality may improve once processing is complete.

.. is back in town. What can be said that wasn't already noted in the posts today? Days like this really do try the souls of men (and women,) but we pick up, regroup and take what we get tomorrow. Hopefully it won't involve another can of whoop. From rumors about the purchaser(s) of the IMF gold to Obama's proposal to ban all foreclosures, (that's right folks, not only will they make sure stocks never go down again, but now they want to make it illegal to be foreclosed on. That ought to make banks anxious to make new home loans, right?) it was one of "those" days we've seen all too often. Who cares how it was manipulated, it happened, case closed. The bear was scalped again. Brush yourselves off and be ready to trade tomorrow with your best skills and a positive mind-set at the ready. That’s how we trade around here, and exactly the reason we indeed have had a better year overall. “Since the house is on fire let us warm ourselves.” ~Italian Proverb Capiche? Me too… ;-) FX traders, we don’t thank you enough for your watchful eyes, so here’s a big thanks to you all, and good trading to you tonight! To some of our newbies, Hibernatin’, loser, SoulJester, Gump.. and all of the rest: welcome on board, we look forward to your contributions.

.. is back in town. What can be said that wasn't already noted in the posts today? Days like this really do try the souls of men (and women,) but we pick up, regroup and take what we get tomorrow. Hopefully it won't involve another can of whoop. From rumors about the purchaser(s) of the IMF gold to Obama's proposal to ban all foreclosures, (that's right folks, not only will they make sure stocks never go down again, but now they want to make it illegal to be foreclosed on. That ought to make banks anxious to make new home loans, right?) it was one of "those" days we've seen all too often. Who cares how it was manipulated, it happened, case closed. The bear was scalped again. Brush yourselves off and be ready to trade tomorrow with your best skills and a positive mind-set at the ready. That’s how we trade around here, and exactly the reason we indeed have had a better year overall. “Since the house is on fire let us warm ourselves.” ~Italian Proverb Capiche? Me too… ;-) FX traders, we don’t thank you enough for your watchful eyes, so here’s a big thanks to you all, and good trading to you tonight! To some of our newbies, Hibernatin’, loser, SoulJester, Gump.. and all of the rest: welcome on board, we look forward to your contributions.

On the economic calendar tomorrow:

Before the bell: GDP, followed by Chicago PMI and Consumer Sentiment at 9:45. Existing Home Sales Data will be released at 10:00 AM.

|  |

|  |

|  |

Sing it loud, TTWrs!

Ten rules for position sizing:

1. Bet high enough to make meaningful profits when you win.

2. Bet low enough so you are ok financially and psychologically when you lose.

3. If (1) and (2) don't overlap, don't trade.

4. Don't go adding a bunch of rules that don't work, just so you have ten rules.

Speaking of "Don't go adding a bunch of…" – there is nothing to say, nothing really new or surprising, we set on downside, we survived today's …ehh..how to say it politely… "Witch hunt", "short rules for long John Q. Public", "convulsive moves of clinically dead market" … and I heroically {temporary} won the battle for normal blog functioning (it has been a while since my "techy" days). Market ended up, futures falling down, we are going in that direction..yes – that one..why are you keep asking?

The answer I'd like to know:

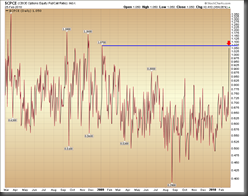

"What do you like more - Keirsten's hand crafted/counted D-Wave chart of (FCX) or that really ugly girl?"

{For the record – I've never seen anything more beautiful than Special K's chart…}

"Ugly girl"

"Special K's Beautiful Chart"

P.S. How dare are you to ask what this post has got to do with "position sizing" or "any "sizing"

Today's economic data

Weekly Bill Settlement

Durable Goods Orders

![[Report]](http://bloomberg.econoday.com/images/bloomberg/byreport_butt_new.gif)

![[Star]](http://bloomberg.econoday.com/images/bloomberg/star.gif) 8:30 AM ET

8:30 AM ET

Jobless Claims

![[Report]](http://bloomberg.econoday.com/images/bloomberg/byreport_butt_new.gif)

![[djStar]](http://bloomberg.econoday.com/images/bloomberg/djstar.gif) 8:30 AM ET

8:30 AM ET

Sandra Pianalto Speaks

8:35 AM ET

Ben Bernanke Speaks

9:00 AM ET

FHFA House Price Index

10:00 AM ET

10:00 AM ET

EIA Natural Gas Report

![[djStar]](http://bloomberg.econoday.com/images/bloomberg/djstar.gif) 10:30 AM ET

10:30 AM ET

3-Month Bill Announcement

11:00 AM ET

11:00 AM ET

6-Month Bill Announcement

11:00 AM ET

11:00 AM ET

James Bullard Speaks

12:30 PM ET

7-Yr Note Auction

1:00 PM ET

1:00 PM ET

Fed Balance Sheet

4:30 PM ET

4:30 PM ET

Money Supply

4:30 PM ET

4:30 PM ET

The highly anticipated DM sell signal went swimmingly well for those of us in position today, but now the question arises: the signal went away on both the daily and hourly charts today, so the road is a little more foggy, but we'll watch the charts, keep all eyes on any and all other pertinent TA signals and trade carefully. It was mentioned by Fuji that volume was once again on the light side, and although I agree, I also see that as a potential game changer in the works. Why? Well, because light volume has meant helium filled ramp jobs, and that trick didn’t seem to work today, so it’s those little changes that we need to monitor. ( kind of like that repetitive pattern of every Monday is a slam dunk bull run- as Bob Dylan sang, “The times, they are a changin’?)

The highly anticipated DM sell signal went swimmingly well for those of us in position today, but now the question arises: the signal went away on both the daily and hourly charts today, so the road is a little more foggy, but we'll watch the charts, keep all eyes on any and all other pertinent TA signals and trade carefully. It was mentioned by Fuji that volume was once again on the light side, and although I agree, I also see that as a potential game changer in the works. Why? Well, because light volume has meant helium filled ramp jobs, and that trick didn’t seem to work today, so it’s those little changes that we need to monitor. ( kind of like that repetitive pattern of every Monday is a slam dunk bull run- as Bob Dylan sang, “The times, they are a changin’?)  this it's simply stunning to watch things unfold. This takes a whole lot of effort from each and every one of you each day, and anyone who thinks there aren't long hours and hard work to prep a plan like this have never traded a tape like we've had these past months. Many, many thanks to everyone. The skills are becoming better with each passing day for all of us. Let’s move on to some charts.

this it's simply stunning to watch things unfold. This takes a whole lot of effort from each and every one of you each day, and anyone who thinks there aren't long hours and hard work to prep a plan like this have never traded a tape like we've had these past months. Many, many thanks to everyone. The skills are becoming better with each passing day for all of us. Let’s move on to some charts.  |  |

|  |

|  |

|  |

Elliott wavers sometimes hear the criticism that patterns in market charts can be "open to interpretation." For example, what looks like a finished 1-2-3 correction to one analyst, another analyst may interpret as 1-2-3 of a developing impulse, with waves 4 and 5 on the way.

Does this happen? Absolutely. (Although, there are always tools an Elliottician can employ to firm up the wave count.) But here's the real question: What's the alternative?

Typical alternatives amount to analysis of the "fundamentals": Jobs, interest rates, CPI, PPI, what Ben Bernanke said on Tuesday -- it all goes into the pot. Result? Well, if you think it's clear and unambiguous, guess again. Here's a fresh example.

Find out what really moves markets -- download the free 118-page Independent Investor eBook. The Independent Investor eBook shows you exactly what moves markets and what doesn't. You might be surprised to discover it's not the Fed or "surprise" news events. Learn more, and download your free ebook here.

On the evening of February 18, in a surprise move, the Federal Reserve raised its discount rate -- the interest rate at which it lends money to banks. The next morning the S&P futures were pointing lower; everyone was bracing for a weak day -- because, as conventional thinking goes, higher interest rates are bad for business, the economy, and ultimately for the stock market. Friday morning, stocks indeed opened lower and major news headlines confirmed:

But around 11am that same morning, the DJIA turned around and moved higher. Now look at what the headlines from major sources were saying after lunch on February 19:

What was a "bearish move" by the Fed in the morning morphed into a "bullish" one by the afternoon! Same event. Same market. Same day. Completely opposite interpretation!

This brings to mind the answer EWI's President Robert Prechter once gave when asked about the objectivity of Elliott wave analysis. Bob said:

"I always ask, 'compared to what?' There is no group more subjective than conventional analysts who look at the same 'fundamental' news event -- a war, the level of interest rates, the P/E ratio, GDP reports, you name it -- and come up with countless opposing conclusions. They generally don’t even bother to study the data. Show me a forecasting method that is totally objective or contains no human interpretation. There is no such thing, even in a black box. To answer your question more specifically, though, properly there should be no subjectivity in interpreting Elliott waves patterns. There is a set of rules and guidelines for that interpretation. Interpretation gives you only the most probable scenario(s), not a sure one. But people mislabel probabilistic forecasting as subjectivity. And subjectivity or bias can ruin that value, just as in any other approach. Sometimes we screw up. But in contrast to the outrageously improbable (if not downright false) wave interpretations or other types of forecasts we often see from others, we are as close to an objective service as you’re going to find. We hire analysts who know the rules of Elliott cold."

Find out what really moves markets -- download the free 118-page Independent Investor eBook. The Independent Investor eBook shows you exactly what moves markets and what doesn't. You might be surprised to discover it's not the Fed or "surprise" news events. Learn more, and download your free ebook here.

Vadim Pokhlebkin joined Robert Prechter's Elliott Wave International in 1998. A Moscow, Russia, native, Vadim has a Bachelor's in Business from Bryan College, where he got his first introduction to the ideas of free market and investors' irrational collective behavior. Vadim's articles focus on the application of the Wave Principle in real-time market trading, as well as on dispersing investment myths through understanding of what really drives people's collective investment decisions.

| 02/23/2010 Futures approx. BO |

|

|

|

|

| Daily Range Projections | Low | High | Low Tolerance | High Tolerance |

| /ES S&P500 Futures | 1105.63 | 1114.88 | 1104.61 | 1107.39 |

| /NQ NASDAQ100 Futures | 1815.75 | 1838.50 | 1815 | 1822.16 |

| /DX US Dollar Index Futures | 80.338 | 80.653 | 80.64 | 80.74 |

Follow IntraDay Updates on Twitter

Today's economic calendar

ICSC-Goldman Store Sales ![[Report]](http://bloomberg.econoday.com/images/bloomberg/byreport_butt_new.gif)

7:45 AM ET

7:45 AM ET

Redbook ![[Report]](http://bloomberg.econoday.com/images/bloomberg/byreport_butt_new.gif)

8:55 AM ET

8:55 AM ET

S&P Case-Shiller HPI ![[Report]](http://bloomberg.econoday.com/images/bloomberg/byreport_butt_new.gif)

![[djStar]](http://bloomberg.econoday.com/images/bloomberg/djstar.gif) 9:00 AM ET

9:00 AM ET

Consumer Confidence ![[Report]](http://bloomberg.econoday.com/images/bloomberg/byconsensus_butt.gif)

![[djStar]](http://bloomberg.econoday.com/images/bloomberg/djstar.gif) 10:00 AM ET

10:00 AM ET

State Street Investor Confidence Index  10:00 AM ET

10:00 AM ET

4-Week Bill Auction  11:30 AM ET

11:30 AM ET

2-Yr Note Auction  1:00 PM ET

1:00 PM ET

James Bullard Speaks

5:00 PM ET

Disclaimer: This website may include stock and market analysis. Any opinions, ideas, views and statements expressed here are opinion only, subject to change without notice and for informational purposes only. Trading stocks carries a high degree of risk. It is possible that an investor may lose part or all of their investment. Accuracy and timeliness of any information is not guaranteed and should only be used as a starting point for doing independent additional research allowing the investors to come to his or her own opinion. Nothing on this blog is to be considered a buy, hold or sell recommendation. Any investments, trades and/or speculations made in light of the opinions, ideas, and/or forecasts expressed or implied herein are committed solely at your own risk, financial or otherwise. Results are dependent on market conditions, timing and trading style. This blog is not affiliated with Tom DeMark in any way and does not claim to represent his estate or personal views. Any references to Tom DeMark or any of his indicators are for educational use only. Comments posted on Disqus Threads are not moderated and are not representative of opinions of authors of this site.

For newbies and lurkers out there: You will read many, many various trading observations,opinions and calls on this blog, from bullish to bearish- that’s why we’re different here. You will often see us challenge each other- and often. It is YOUR responsibility to understand and/or ask questions if you’re confused or want help/further opinion… we can’t read your mind. This is a place of learning and sharing, but the trading is YOUR responsibility alone, not ours. Rule #1- never take a trade that is not based on your own T/A and choice. Lead yourself, do not follow. I can’t emphasize that enough. Read the disclaimer at the bottom of this blog site completely, if you haven’t already. I have seen plenty of “gurus” with loads of happy followers take their trades blindly with both good AND bad results - don’t let yourself be one of those people

Disclaimer: This website may include stock and market analysis. Any opinions, ideas, views and statements expressed here are opinion only, subject to change without notice and for informational purposes only. Trading stocks carries a high degree of risk. It is possible that an investor may lose part or all of their investment. Accuracy and timeliness of any information is not guaranteed and should only be used as a starting point for doing independent additional research allowing the investors to come to his or her own opinion. Nothing on this blog is to be considered a buy, hold or sell recommendation. Any investments, trades and/or speculations made in light of the opinions, ideas, and/or forecasts expressed or implied herein are committed solely at your own risk, financial or otherwise. Results are dependent on market conditions, timing and trading style. This blog is not affiliated with Tom DeMark in any way and does not claim to represent his estate or personal views. Any references to Tom DeMark or any of his indicators are for educational use only. Comments posted on Disqus Threads are not moderated and are not representative of opinions of authors of this site.

Trading to Win is powered by  | Theme by Thur

| Theme by Thur