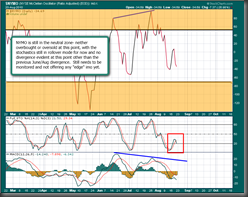

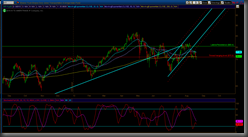

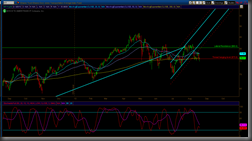

I just went over a pile of charts looking for something- anything that would give an edge, and I really don't see it at this point. Monday has the usual ST cycle advantage for the longs, but beyond that- the daily and weekly charts give nothing solid, imho. It's flip of the coin time by the look of it. If we continue down into the high 1050s on Monday, I'd be more apt to trade for a bounce from there, but carefully. If we bounce Monday- I like the short odds setting up for mid-week, etc.. Anyway- a quick weekend hodge podge of charts., and a few individual names I ‘m watching. Just remember- Laundry's date was not "exact" in 2007, although pretty darned close. I'm not liking the high level of focus on the HO either at this point, but only due to the chronic use of these popular TA signals/woo doo that have trapped bears once too many times.

Also- for 13/34 fans, check out those EMAs on the current index charts. *Those* I like a lot here, as well as NYSI and NYMO at this point for MT trend trading.

For the Benefit of Mr. Kite and Osi, in case he forgets: Full moon on Tuesday.

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

And a huge regret on my part….

|  |

Best to you all this coming week- look sharp. :-)