Today's marks the 34th day since the July 1st low- a nice Fibonacci number. As we discussed earlier in the chat, oil inventories are still building and the initial target was hit on the Gartley pattern and /CL closed with a doji below the .786 Fib target. Is it time to short it? Wait for the trade and SOH until the next moves prove the pattern (or not.) I think I mentioned to Inna earlier this week, I can't see this tape moving down until copper and oil turn around at the very least. Just to put the icing on the cake, GS went parabolic this morning, and that surely won't help the shorts either. Urghhhh. One thing is for sure, and I’ll give Merriman credit on this- correlations are out the window at this point- just trade the charts and don’t worry your pretty little heads about any of it making sense. It doesn’t need to make sense, it just needs to make us money. ;-)

Today's marks the 34th day since the July 1st low- a nice Fibonacci number. As we discussed earlier in the chat, oil inventories are still building and the initial target was hit on the Gartley pattern and /CL closed with a doji below the .786 Fib target. Is it time to short it? Wait for the trade and SOH until the next moves prove the pattern (or not.) I think I mentioned to Inna earlier this week, I can't see this tape moving down until copper and oil turn around at the very least. Just to put the icing on the cake, GS went parabolic this morning, and that surely won't help the shorts either. Urghhhh. One thing is for sure, and I’ll give Merriman credit on this- correlations are out the window at this point- just trade the charts and don’t worry your pretty little heads about any of it making sense. It doesn’t need to make sense, it just needs to make us money. ;-)

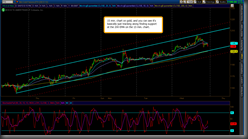

TNX also painted a bullish engulfing on the daily, and if TNX leads, this is not a good sign for the shorts. I'm also tracking the TICK intra-day, and it keeps looking weaker and weaker as price moves up, but I'm not sure if it's just coiling to push this tape higher or what's going on there, but it's something to keep an eye on. I also don't see a decent signal on the TRIN at this point either to get excited about. So it's back to SOH and scalping intra-day for now.

Economic calendar tomorrow includes: Chain Store Sales, Monster Employment Index and Jobless Claims, 8:30 AM. Natural Gas inventory at 10:30, Geithner speaks at noon, Fed Balance Sheet and Money Supply at 4:30 P.M. Friday will feature the UE numbers and later on in the day Consumer Credit- 3:00.

I’ll be gone most, if not all of tomorrow, so keep the peace and trade your very best. See you on Friday if not sooner you little trading maniacs. :-)

|  |

|  |