“Fortunately for serious minds, a bias recognized is a bias sterilized” - Benjamin Haydon

“Fortunately for serious minds, a bias recognized is a bias sterilized” - Benjamin Haydon

Let’s keep that quote in mind going into a new trading week. While we have plenty of evidence pointing to a possible pullback this week, they never make this easy, and will keep playing the same game of gapping up overnight leaving little chance to get long during regular trading hours, much less short this puppy to the full extent it deserves. (note my bias there?) I’m working on it, believe me. There were some absolutely beautiful long set-ups last week, and the question is: did you find something like that to trade while waiting for Godot? Get in both lanes this week, TTWrs. I want to see you pillage and conquer this tape like you’ve done so many times before. By the time Friday rolls around, let’s see some high fives and a few towel snaps for a great week that was well done. We don’t “do” defeat here- it’s not in our vocabulary. The fresh slate begins tomorrow (for you FX traders, tonight.)

Before I share a hodgepodge collection of some possible leading indicator charts (you all covered the general market in spades in the last post,) I’d like to once again welcome all of our newbies- who will hopefully stick around, as we really do appreciate what you bring to the table and add to our ongoing discussion. TTW is a place where we throw everything but the kitchen sink at this tape day in and out, with a very good rhythm, I might add. While DDT started this as a place to discuss DeMark analysis, all ideas and methods are welcome here. We remain humble traders, and thrive on learning something new each and every day. The thrust is to not only personally profit, but hopefully help each other profit as well.

Gann chart for SPX, coming into an important Fib day tomorrow off of the July pivot low

|  |

|  |

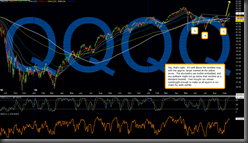

One last chart for good measure. They’ve really been pumping the Qs lately, and let’s face it, this isn’t exactly looking bearish at this point. While it’s possible this had more to do with OPEX than anything else, keep an eye on sector rotation tomorrow. If they’re going north, keep an eye on the RUT and TRANs for shenanigans.

Now.. while I’m working on my bias all the time as it applies to trading, I have a very strong bias to this musician. 40 years ago, yesterday, RIP Jimi. Lets put a little voodoo on Lloyd this week, shall we? ;-)