Welcome to the rubber room, known as your free market. ;-)

Welcome to the rubber room, known as your free market. ;-)

Keep in mind as I mentioned in the previous post, we're still 8 trading days from EOQ now, five days for them to place their orders and have them settled. If you think AAPL can't go any higher, just remember round numbers theory, and for all we know they're taking it up to 300. /HG was pulling back today, and TLT closed green, so let’s monitor them as well for possible early clues. Don’t say I didn’t tell you last night to watch the RUT and TRAN- they pump those puppies with the greatest of ease to run the shorts. TRAN did not finish as strong as the RUT today though, so there’s another thing to monitor.

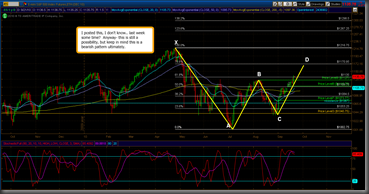

Now.. before you retreat to your fetal positions for the evening, I have one chart to share tonight that isn't too bear friendly.. yet. This is a bearish Gartley. Should /ES exceed the .786 Fib, forget you ever saw me or this chart. I'll be in Mexico.

Good luck tomorrow, traders.

On September 14th on Members SIte

( Do not spit against the wind ) I wrote:

"I plan on getting some short positions at SPY 114.50sh area with tight stops."

So, here we are now, except for, as I mentioned before, "really small long puts position I grabbed during Friday's morning bounce" – I am 100% all cash. New week did provide some "excitement" – nice run up into FED meeting. So, lets look at the charts.

Here is 30 min SPY D-wave in progress – target price for W5 is almost here, I have no doubts it will be hit and possibly exceeded tomorrow either before or right after FED yet another non-even statement.

Hourly SPY shows possible completion of sell setup tomorrow around noon. Interestingly enough – today right at market open – hourly TDCountdown for both TDCombo and TDSequential have been completed with immediate start of momentum Sell Setup.

And last, but not least – looking at my personal long time favorite 4hours chart we can see that today's price action brought SPY all the way to TD Risk Level for most current Sell setup.

OK..I lied ..just like always…one more chart – daily SPY – needs no explanations, same interesting picture – right at TDRL and 62% – just were I wanted it!

ICSC-Goldman Store Sales  7:45 AM ET

7:45 AM ET

Housing Starts ![[Report]](http://mam.econoday.com/images/mam/byconsensus_butt.gif)

![[Star]](http://mam.econoday.com/images/mam/star.gif) 8:30 AM ET

8:30 AM ET

Redbook  8:55 AM ET

8:55 AM ET

4-Week Bill Auction  11:30 AM ET

11:30 AM ET

52-Week Bill Auction  11:30 AM ET

11:30 AM ET

FOMC Meeting Announcement ![[Report]](http://mam.econoday.com/images/mam/byconsensus_butt.gif)

![[Star]](http://mam.econoday.com/images/mam/star.gif) 2:15 PM ET

2:15 PM ET