Many thanks to our own HighPlainsTrader for allowing us to re-post his commentary from his own blog. If you have not been to his blog, you’re really missing out on some great posts over there. He is a tireless contributor to TTW each and every day, bon vivant, all around good human being and has brought so many new things for us to consider as we trade. We are all so grateful to have you here with us. Thank you again, HP. :-)

I have frequently quoted specific passages from books that I have read over the years, and my favorite passage for explaining what I do with my trading is this one from, "The Futures Game" (Teweles).

It is interesting to observe the way most futures traders play the futures game in relation to the possible ways that money games can be played:

1. The most effective approach to the objective of maximizing results is to play a favorable game on a small scale.

2. Less desirable, but still providing a reasonable chance of success, is playing a favorable game on a large scale with enough profits coming early in the game to avoid ruin.

3. A basically unfavorable game may yield profitable results (presuming that one insists on playing unfavorable games) if one plays seldom and bets heavily.

4. The only road that leads inevitably to disaster is playing an unfavorable game continuously.

The trader who trades on impulse or uses some other invalid method of making trading decisions is following the fourth route, which is crowded with bumper-to-bumper traffic.

I consider my options trading to fall into category #3 from that quote. It is basically an unfavorable game because there are so many moving parts. For instance, not too many days ago I was guessing that APPLE (AAPL) would fall after they announced earnings. I was right, the stock got hit for nearly 15 points right when they announced. What happened to my Put? It lost a shitload of value because, and I'm guessing, the implied volatility got crushed after the release of earnings. I was right on the direction of the stock and still lost money.

That was my first attempt at buying an option contract on an individual issue in nearly three years. I hate trading individual stocks because there are too many moving parts there also, too many in fact to begin listing them here. Suffice it to say that my preference for the options arena are the indexes, the S&P500 and Russell2000.

Okay to the point. I have a small account set aside just for playing with options contracts, and yes, I insist on playing that unfavorable game. However, because I can/do/have-gone/will-go all-in, this account has the potential to become very big very quickly; either that or it will blow up very quickly.

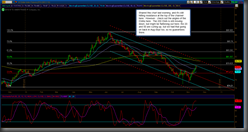

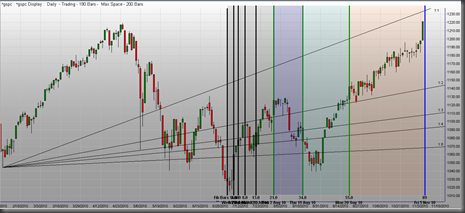

Recently my results in the unfavorable game have been quite stellar, you know, setting aside the Apple trade. Here is a picture of my last 7 trades on the S&P using Puts only. The red arrows mark my entry and the green arrows mark my exits.

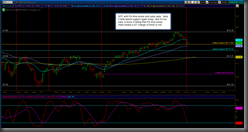

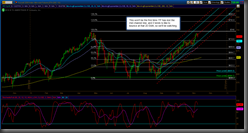

What I am not showing in this chart is the reason for the entry, but I will tell you anyway. I've been looking for a high print in the MACD Histogram bars on the hourly chart to find a spot to take a position. And even though I am trading on an hourly time frame, I then look at a 15-minute chart and a 5-minute chart for the exact time to place the trade. That is, I am doing everything that I do in my regular day-trading account and my swing-trading account to move the odds as much in my favor as possible in this unfavorable game; I'm using multiple time frames for my trading.

So why am I showing this chart and talking about the unfavorable game? Good question, you knew I had a point to make.

I think it's important for traders, especially new traders who may be struggling, to understand that you have to be aware of market conditions on all time frames, you have to beware of the limitations and the dangers of the tools you use to trade, and most importantly you have to be aware of yourself.

When looking at those three things as they relate to my unfavorable game, I can tell you that I am aware of market conditions and I am using multiple time frames for my setups and my exits. I am using options on the big indexes and I am aware that those options come with moving parts that affect the value on a minute-to-minute basis, such the VIX, the underlying components of the index, news and economic releases, and the underlying trend, which brings me to the self-awareness portion of my trading.

When you look at that chart and see that my last seven options trades against the index (all winners) have been during an uptrend, you have to know that I am aware that I am the trend-fighter, or the counter-trend trader. I am aware of the fact that I am a reversion-to-mean kind of trader, especially when it comes to the unfavorable game.

I may switch back and forth from trend fighting to trend following with my day- and swing trading, but when it comes to the unfavorable game I am most definitely a trend-fighter. If you pull up a similar chart to the one I've shown and put a moving average on it, you will see clearly that I am looking for a pullback to a moving average. I am a trend-fighter.

This post is not an attempt to sell you or anyone on the best method of trading. There are as many people, in my opinion mostly losers who are trying to convince themselves more than trying to convince you, who will tell you that the big money is made by following the trend. I don't believe it, mainly because I live the other side of that argument.

This post is more about awareness and having a plan, and realizing that no matter what, when it comes to trading in the stock market or the futures market, you may have to be aware that you are playing in an unfavorable game even if you think otherwise.