Adam Hamilton September 17, 2010 2211 Words

After weathering a lackluster grinding summer, commodities stocks are poised for a big rally. Thanks to an anomalous divergence between commodities prices and the general stock markets, commodities stocks are relatively cheap today. This has created an excellent buying opportunity for investors.

Commodities stocks, of course, are in the business of exploring for and producing raw materials. These resources are exceedingly important, indeed utterly indispensable for life and commerce. Even in this young Information Age, our entire physical world is built out of commodities. All physical movement is fueled by commodities. And despite new resource finds getting scarcer, world demand continues to grow relentlessly.

Commodities stocks’ profits are directly driven by commodities prices. The higher these resources’ prices travel, the greater the raw profits and margins for producing these products. And in the stock markets, the larger any company’s long-term profits the higher its stock price will be bid. So as the ironclad links of this causal chain show, it is commodities prices that ultimately drive commodities-stock prices.

But over the short term, sentiment heavily affects commodities-stock price levels. Even today a decade into these secular commodities bulls, Wall Street still considers these top-performing stocks exceptionally risky for some strange reason. So when general-stock-market psychology is happily bullish, commodities stocks surge higher much faster than the broader markets. And conversely when Wall Street waxes bearish, the commodities-stock sectors readily leverage general-stock downside.

In light of this background, a very bullish anomaly has developed in today’s markets. Commodities prices have been rallying strongly, guaranteeing higher future profits (and hence stock prices) for commodities producers. Yet at the same time, the general stock markets have been grinding sideways while fighting intense mainstream anxiety. And commodities stocks have latched on to this stock-market malaise, ignoring the rallying prices of the products they produce.

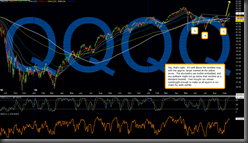

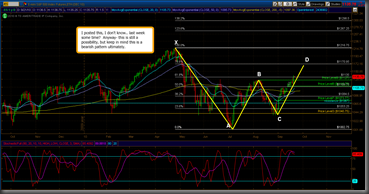

This situation is easy to see on a chart. Commodities prices are best represented by the Continuous Commodity Index, the new name for the old-school equally-weighted geometrically-averaged CRB index. The CCI is much more representative than today’s so-called “CRB”, which is now dominated by crude oil. And of course the general stock markets are best represented by the flagship S&P 500 stock index (SPX).

On this chart the SPX, which dominates short-term commodities-stock sentiment, is slaved to the left axis in red. Superimposed over that is the CCI, which ultimately drives commodities-stock profits, in blue. While commodities prices have been rallying sharply and have returned to pre-stock-panic levels, commodities stocks have been ignoring them to languish in the broader SPX’s sideways grind.

Late 2008’s epic once-in-a-century stock panic was not kind to commodities. Technically that brutal period ran from when the classic VXO fear gauge first exceeded 50 on September 29th to when it finally fell back under that panic-defining level on December 19th. Over that unbelievably-wild 58-trading-day span, the markets weathered a raging fear storm like no one alive today had ever seen before.

But to streamline today’s analysis, I broadened this panic span to include all of September, October, November, and December 2008. That year prior to those fateful panic months, the CCI and SPX were completely uncorrelated. Their correlation r-square ran a paltry 11% based on a negative underlying correlation. Commodities did their own thing regardless of what the general stock markets were doing.

This changed radically during the panic months, where the CCI/SPX r-square soared to a staggering 92% on a positive correlation. Investors worldwide were so terrified that they dumped everything regardless of fundamentals. As the stock markets plummeted, futures traders feared a new global depression so they jettisoned commodities at a frightening pace. Exacerbating this already-mighty commodities selloff, flight capital deluged into the US dollar. The resulting rallying dollar farther weighed on commodities prices.

While the SPX ultimately plunged 53% in 10 months as a result of that panic, commodities didn’t fare much better. The CCI plummeted 47% in just 5 months! With both their sentiment driver (SPX) and fundamental driver (CCI) in free falls, elite commodities stocks including the world’s biggest and best producers lost between 60% to 90% of their stock prices! Such carnage was utterly unprecedented.

Since that panic period, both general stocks and commodities prices have rallied tremendously. The post-panic CCI and SPX rallies were very similar and intertwined, a testament to how ridiculously oversold both commodities and stocks became during the panic. But despite this powerful CCI rally, still today most commodities-stock traders remain so skittish that they look to the SPX for guidance instead of the CCI.

This year’s first half wasn’t great for the CCI. Earlier in 2010, commodities prices were consolidating sideways while the stock markets were still rallying. And then when the SPX corrected sharply in May and early June, the CCI followed it down to new 2010 lows. But ever since that early-June CCI bottom, commodities have been rallying strongly. In normal times, commodities stocks would have followed them higher and leveraged their gains. But lately they’ve mirrored the grinding SPX instead.

Interestingly, by early last month the CCI had actually fully recovered all its panic losses. Meanwhile the SPX had recovered most of its own, but still remained well behind the CCI’s recovery. It is this development that drove today’s commodities-stock price anomaly. Since commodities stocks ignored the CCI’s entire recent 17% rally over 3 months, they are now very undervalued relative to today’s commodities prices.

In order to better understand the relative performances of the CCI and SPX since the panic, I indexed each. This renders them in perfectly-comparable percentage terms and eliminates visual distortion. They are both set at 100 at their closes on the last trading day of August 2008, the eve of those 4 panic months. As each fell 10% it hit an index level of 90, 20% equals 80, and so on. This comparison is fascinating.

In those panic months, the percentage decay curve of the CCI was nearly identical to that of the SPX! This is startling and remarkable. Because of the CCI’s geometric averaging across commodities and between individual contract months within commodities, it is usually slow to move. So to see this particular heavily-smoothed index match the SPX’s first true panic plunge since 1907 is really extraordinary.

The SPX panic reached its nadir in late November 2008, and the CCI bottomed just 2 weeks later in early December. Ever since then commodities have been rallying on balance despite the secondary SPX low in early 2009. Just after the Obama Administration took office in January 2009, the SPX plunged sharply.

Why? Remember the arrogant Democrats attacking hard-working American investors, saying our huge tax burden was too low and they were hellbent on raising it? They were also advancing scary Marxist class-warfare doctrine, an abhorrent anti-American philosophy Obama continues to poisonously spew today. Thankfully the Democrats are about to pay a heavy price at the voting booths for their endless demonization of American small businessmen who have earned success and created most jobs.

Amazingly the stock markets were so ridiculous oversold by early March 2009 that not even the Democrat Despair could hold them down. As they started recovering in a fantastically-profitable new cyclical bull, commodities prices followed them higher. There is a super-important psychological link between stock prices and commodities prices that all investors must understand in order to succeed.

The fortunes of the stock markets affect sentiment universally. When they are rising, everyone feels better even if they aren’t investors themselves. When they are falling, everyone feels worse. Rising stock markets also make traders assume the global economic outlook must be improving. And the better the world economy looks, the faster global commodities demand will grow. So a rising stock market leads futures traders to bid up commodities prices, and vice versa. The SPX heavily influences the CCI.

But provocatively, the SPX often falls behind and lags commodities before surging rapidly to catch up again. We first saw this in early 2009 when Obama threatened the most massive federal-government growth and attacks on Americans’ financial freedom that we’ve seen in decades. Nevertheless, by mid-2009 the SPX had caught up with the CCI in perfectly-comparable indexed terms.

This disconnect happened again in late 2009, when the CCI surged higher decisively while the SPX reluctantly consolidated higher. But in early 2010 the SPX once again caught up with the CCI to match its post-panic performance perfectly. Though the CCI corrected a bit in early 2010, at the point where the SPX caught up to it general stocks were trading at their best levels since the stock panic and commodities weren’t too far behind.

Once again for the third time in mid-2010, the SPX fell behind the CCI. While the CCI started rallying strongly in early June, the SPX just ground sideways in its anxiety-laden summer spawned by the healthy spring correction. The result, as you can see on this chart, is the biggest gap between absolute CCI and SPX performance that we’ve seen since early 2009. This gap is the anomaly that is so darned bullish for commodities stocks today.

In this entire post-panic recovery, every time commodities advanced ahead of the stock markets, stocks soon surged to catch up and match commodities’ progress. I really doubt this pattern will suddenly break today. The SPX’s cyclical bull is alive and well, and coming out of the low summer base there is a great technical and sentimental setup for a big rally in the coming months. Heck, just the prospect of throwing out some of the Democratic Marxists who have so damaged American economic confidence is super-bullish!

And if the SPX once again surges to catch up with the CCI’s absolute performance, it is very bullish for commodities stocks on multiple fronts. First, commodities stocks are very undervalued relative to today’s commodities prices since they have been following the consolidating SPX instead of the rallying CCI. So they are starting from an oversold and unloved base, which means any investor buying will have a disproportionately-large impact.

Second, a rallying SPX will improve economic confidence. This means futures traders will likely bid the commodities prices even higher, effectively slowing the progress of closing this gap. Of course higher commodities prices make commodities stocks look much more attractive to investors, intensifying any new investment demand. An improving economic outlook, rising stock markets, rising commodities, and improving sentiment all feed on themselves and form virtuous circles.

Third, as the SPX rallies the fear trade including the US dollar is sold. A falling dollar leads to higher dollar-denominated commodities prices, encouraging commodities-stock demand among investors. This indirect dollar-negative impact of the SPX-rally-driven reversal of the fear trade will add fuel to the fire under commodities prices. Futures traders get excited about commodities when the US dollar is trending lower.

Fourth, commodities stocks usually leverage SPX gains. So as the SPX rallies to rejoin the CCI’s progress, commodities stocks should surge much faster than the general stock markets. Of course nothing gets mainstream investors more excited than rapidly-rising stock prices, so this phenomenon too will feed on itself once it gets underway. This week we are already seeing this start in smaller commodities stocks.

Each of the past times the SPX rallied to catch up with the leading CCI, commodities stocks rallied sharply. This time ought to be even better due to overarching sentiment trends. The majority of American investors have been hiding out in zero-yielding cash and near-record-low-yielding Treasuries since the panic. They are tired of watching the Federal Reserve inflate their capital away. As they start to return to the markets, they will chase performance. And commodities stocks will likely be the best-performing sectors.

At Zeal, we’ve been preparing for the end of this anomaly since it first started developing in May. Since then we’ve gradually layered into dozens of high-potential smaller-commodities-stocks trades with great odds of soaring in this coming rally. Today the trading books in our acclaimed monthly Zeal Intelligence and weekly Zeal Speculator newsletters are full of fantastic commodities stocks ready to rocket. While we’ve already seen nice gains in most of these positions, it isn’t too late for you to buy.

Despite the countless opportunities in recent months, most investors have been hypnotized by the anxious drumbeat of fear, paralyzed into inaction. As these ostrich investors wake up and return, their trillions of idle cash have the potential to drive huge rallies. We’ve been specializing in commodities stocks for over a decade, earning awesome returns for our subscribers. You too can share in our knowledge, wisdom, and experience as we continue to uncover new opportunities. Join us today!

The bottom line is commodities stocks are very undervalued relative to commodities prices today. While the latter have enjoyed a strong rally since June, commodities stocks have languished in the stock markets’ sideways consolidation. This anomalous disconnect cannot persist, as it is commodities prices that drive commodities-producers’ profits, and ultimately any company’s profits drive its stock price.

So even if the stock markets continue to do nothing, commodities stocks are overdue for a big rally. But every other time since the panic when the stock markets have fallen behind commodities’ recovery, the stock markets soon surged to catch up. This time probably won’t be any different. As commodities stocks usually leverage stock-market gains, another catch-up rally amplifies commodities stocks’ potential.

Adam Hamilton, CPA September 17, 2010

![[Report]](http://mam.econoday.com/images/mam/byconsensus_butt.gif)

![[Star]](http://mam.econoday.com/images/mam/star.gif)