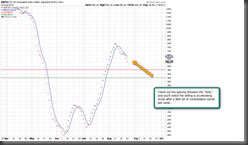

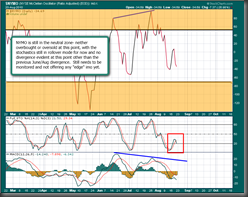

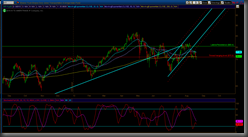

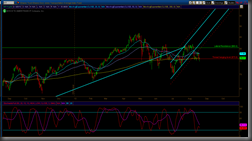

Last week as speculated was tight range bound trading, but nevertheless closing prices permitted TD Setup Buy for SPY on daily to complete. This is the second time recently when Buy Setup completed around 50-62% retracement of W3 D-Wave UP on daily (yellow arrows) and quite possible that area will provide support and trampoline for move up. I think 109-110 area will be very telling IF in fact move up will materialize.

Off the topic – reporting on my mid life crisis – went out to drive cheap, but powerful sport coupe (YUP – imagine that – HUYNDAI !!! I though I would never be caught alive in that dealership…here I go…cheap old fart…but I ended up talking home (just for few days – to try) Lotus Elise…what a fun little car…but you better be damn sure you are close to gas station – I have no idea what idiot put such a small fuel tank in that "dune baggy" – that explains why I came home 2 hours later than planned :(

Pease, refrain from comment on "20 something girlfriend" and "pull me off" yellow color!